Need To Reorder Checks Here Is What You Need To Know

Need to reorder checks? Here is what you need to know

Bank checks are vital instruments for carrying out financial transactions. They provide a secure method of transferring hefty amounts of money. Whether it is a personal banking account or a business account, banks give its users the facility of using checks. Thus, bank checks are essential for everyone. If you’re running out of bank checks, you need to reorder them as soon as possible.

Here are the steps that will help you reorder bank checks.

Do I need to visit a bank branch to order checks?

- You can put in an online order for checks directly through your bank’s website. However, if you are ordering bank checks for the first time, the bank may ask you to visit their branch to verify your identity and get your account information.

- Since checks are meant to pay money to third parties, banks need to make sure that malicious elements don’t lay their hands on these checks. If these get into the wrong hands, they can be misused for fraudulent activities. Hence, many banks insist that customers visit their branch to order their checks for the first time.

What are the basic steps you need to take before re-ordering checks online?

- If you have used the bank’s website for its online banking facilities in the past, you can go online to reorder checks too.

- Enter your user ID and password in the online banking page of your bank. If you don’t have your online banking credentials, you need to create them.

- The bank needs to confirm your identity to create these credentials. They may ask you for some information like your account number, name, account type, address, debit or credit card number, etc. via their website. They may also ask you for your Social Security number.

- In the end, the bank will send a user ID and password to your home, or they will send it via text or email.

- After you have your login credentials, you will be able to access your online account easily. Just enter your ID and password to sign in. Then, to access your online account, you need to select “My Account,” “Checking Account” or “Accounts Services” depending on the bank with whom you have an account.

How do you place a check reorder request online?

- After you’ve accessed your online account, you need to look for the section that has an option to reorder checks. The location of this tab would differ from one bank to another.

- Click on the relevant tab to reorder checks. The page may ask you to update information regarding your account.

- If you have relocated since you last placed an order for checks, or if you need the bank checks to be delivered to a new address, you need to put in that address. If there is no change, confirm that the details are the same as before.

- In case there is a change in your name for any reason, you may have to update that information to the bank’s database.

- For most financial institutions, you have to visit that institution to put in a change of name request. You also need to submit all the requisite documents that certify this change, such as your marriage certificate or a decree absolute, depending on the reason for the name change.

What is a routing number?

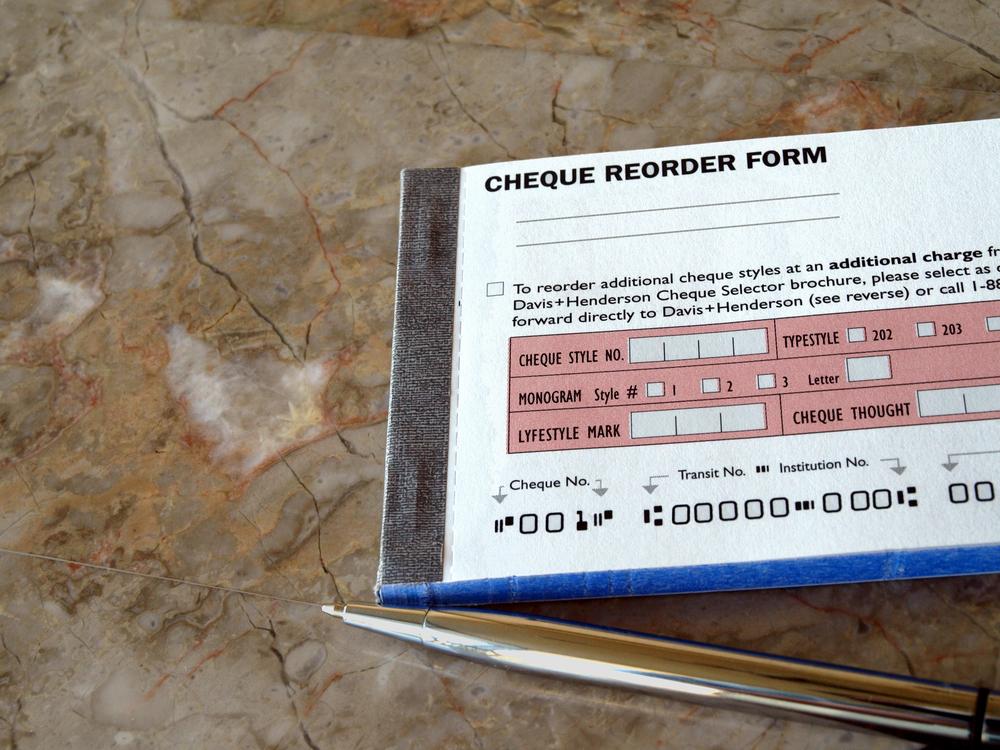

- You need to know the routing number of your bank to reorder checks. A routing number is a 9-digit number that you will find at the bottom of your checks. The banks need this number to identify the financial institution associated with your account.

- You need to put the routing number along with your account number and account type in the check order tab. This step would also verify that you are ordering the right check for the correct account type as well as the account number since you may have multiple accounts in the same banks.

What is the cost of ordering checks?

- The expense of ordering checks varies from bank to bank. However, the usual cost is around $25 or less. For deducting this amount from your account, you may need to put in your credit or ATM card information.

- However, if your checking account comes with the facility of free checks, you don’t need to pay anything.

Disclaimer:

The content provided on our blog site traverses numerous categories, offering readers valuable and practical information. Readers can use the editorial team’s research and data to gain more insights into their topics of interest. However, they are requested not to treat the articles as conclusive. The website team cannot be held responsible for differences in data or inaccuracies found across other platforms. Please also note that the site might also miss out on various schemes and offers available that the readers may find more beneficial than the ones we cover.